In the ever-evolving insurance landscape, companies constantly seek ways to streamline their operations. That said, business process outsourcing has emerged as an effective way of managing essential administrative tasks. This solution allows insurance agencies to focus on their core functions while delegating specific services to external partners. But which insurance services can be outsourced?

As one of the top insurance BPO companies, we’ve decided to share what tasks our clients are outsourcing with us. We specialize in providing tailored insurance outsourcing services to different agencies, and in this article, we will explore critical insurance functions that you can outsource for optimal efficiency and cost-effectiveness.

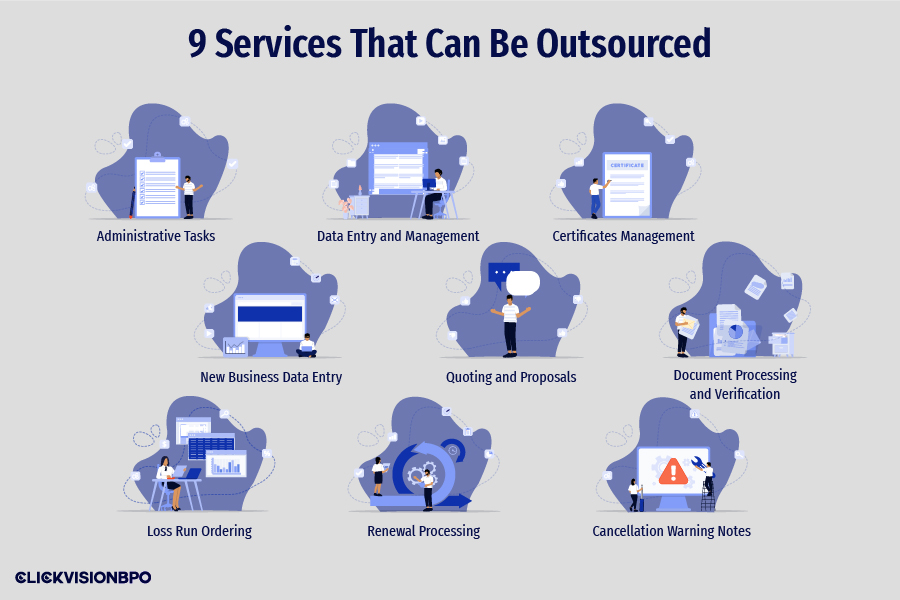

Which Insurance Services Can Be Outsourced?

As of late, the strategic integration of BPO services has been a game-changer in the insurance domain. In this section, you will explore the most common outsourced insurance services intended to improve organizational performance and contribute to operational efficiency.

1. Administrative Tasks

As part of the dynamic insurance industry, your insurance agency may face challenges while managing complex and time-consuming administrative tasks. However, outsourcing has emerged as a strategic imperative for addressing them.

Your team may get overwhelmed by the volume of data they have to handle on a daily basis. Yet, by outsourcing, they can leverage the expertise of professionals who can manage such tasks promptly and efficiently, reduce errors, and save costs.

In fact, outsourcing back-office tasks enables greater scalability and flexibility. With outsourcing services, you can ensure your administrative tasks are handled accurately and in compliance with industry regulations.

Source: freepik.com

2. Data Entry and Management

Insurance companies often deal with a large pool of data on a day-to-day basis. However, BPO services have a crucial role in managing data entry processes. They ensure the massive volume of information is accurately transcribed into the system. They guarantee precision and elevate the burden of the in-house teams.

BPO providers, such as our team at CLICKVISION BPO, specialize in organizing, categorizing, and maintaining the integrity of vast datasets. This approach streamlines daily operations and enables your agency to extract valuable insights. It facilitates quicker decision-making and response to the market dynamics.

The professional entry specialists provide quick and error-free services. They are equipped and trained to cater to your business needs and have the knowledge and experience to handle any type of data.

3. Document Processing and Verification

Efficient document processing and verification are crucial in insurance. Outsourcing services streamline these tasks, ensuring policies and claims are processed accurately. BPO providers specialize in handling intricate procedures such as sorting, categorizing, and storing documents with precision.

They often incorporate automation tools and quality control measures to ensure document processing is swift and free of inaccuracies. Verification, a critical component in the insurance workflow, is also adeptly managed by BPO services.

Whether it’s verifying policyholder information, claims documents, or compliance-related paperwork, outsourcing this aspect to specialized providers establishes a thorough and systematic validation process.

4. Certificates Management

Certificates bear crucial information related to policies and legalities, and their handling is integral to insurance operations. Therefore, by choosing to outsource certificate of insurance services, agencies can offload the complex processes associated with certificate management. They ensure the policyholders maintain accurate and up-to-date records.

Business Process Outsourcing (BPO) providers working with insurance agencies use their systems to manage certificates of insurance. These systems enable BPO providers to issue certificates to clients, vendors, and other stakeholders in a timely manner.

In addition, BPO services ensure that certificates are produced accurately and on time. This is particularly crucial in meeting client expectations, regulatory requirements, and industry standards.

Source: freepik.com / Photo Contributor: diloka107

5. New Business Data Entry

Efficient data entry for new business applications is the cornerstone of insurance operations. BPO providers bring precision and speed to the data entry process for new policies, ensuring that all critical information is accurately recorded.

The role of outsourcing services in new business data entry begins with the collection of information from various sources, like application forms and client submissions.

BPO providers offer insurance data entry services, which include inputting, updating, or managing various types of data for their clients. This can include completing tasks like transcribing handwritten documents into digital formats, entering customer information into databases, or processing forms and surveys.

The trained personnel aim to ensure accuracy and efficiency in data entry tasks. Such services also ensure the entered information aligns with predefined criteria and regulatory standards.

6. Quoting and Proposals

Generating quotes and proposals demands accuracy, competitiveness, and promptness. Outsourcing services excel in this area. They assist insurance agencies in producing accurate quotes and compelling proposals and can help in attracting potential clients.

They extract relevant data from diverse sources, assess risk factors, and utilize pricing models to generate accurate quotes. This allows you to respond promptly to client inquiries and fosters a competitive edge in the market.

By analyzing client needs, coverage requirements, and risk factors, BPO specialists assist in crafting proposals that align with industry standards and cater to the clientele’s specific needs.

7. Loss Run Ordering

An equally crucial aspect when it comes to insurance operations is ordering loss runs. BPO activities ensure that accurate loss run data is obtained promptly for comprehensive risk assessment.

From initiating requests to tracking and managing the retrieval of loss-run data, outsourcing ensures a seamless and organized workflow. Timeliness is crucial in the insurance domain, especially for evaluating risks through loss-run data.

BPO providers prioritize prompt retrieval, ensuring you have access to the necessary information within the stipulated timelines. They employ rigorous quality control measures to validate and verify the accuracy of the data obtained.

BPO services ensure a smooth integration of loss-run data into the insurers’ systems. They offer the flexibility to generate customized loss-run reports tailored to the specific needs of insurers.

8. Renewal Processing

Efficient renewal processing is essential for client retention. With this in mind, outsourcing services handle the intricate steps of this process, ensuring a smooth transition from one policy to another. BPO specialists thoroughly review policyholder data to ensure completeness and accuracy before initiating the renewal process.

They communicate with policyholders in advance, providing renewal notifications and gathering necessary updates or additional information. Moreover, the specialists use data analytics and risk modeling to evaluate policy performance and determine appropriate renewal terms.

Based on the risk assessment, they may recommend policy terms, coverage, and premium adjustments during the renewal processing phase. BPO services also update and maintain documentation related to renewed policies, ensuring compliance with regulatory requirements and internal standards.

9. Cancellation Warning Notes

BPO activities also include sending cancellation warning notices promptly, mitigating risk, and maintaining transparency with policyholders. Timely notices provide policyholders with essential information regarding potential cancellations. They foster open communication and allow clients to address issues before policies run out.

These notices proactively identify and address potential risks associated with policy non-compliance or overdue payments, helping insurers mitigate risks effectively. Such services prompt insurers to work collaboratively with clients, increasing the likelihood of policyholder retention and satisfaction.

Aside from administrative tasks, customer service is significant in insurance outsourcing. It fosters client satisfaction and loyalty. BPO services proficiently handle customer inquiries, providing timely and accurate information.

The process involves addressing and resolving issues promptly, ensuring a positive experience for policyholders, and contributing to overall client satisfaction. For instance, our BPO specialists manage updates to policyholder information, ensuring accuracy in databases and effective communication of any changes to clients.

Such a personalized and responsive approach to BPO customer service contributes to client retention. Satisfied policyholders are likelier to remain loyal to their insurance provider.

Conclusion

The outsourcing landscape has become integral to the efficient functioning of the insurance industry. In this post, you were able to discover which insurance services can be outsourced and improve operational efficiency. As the insurance landscape evolves, such strategic outsourcing services continue to be a driving force in shaping a more agile and competitive industry.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.