In commercial property insurance, proper documentation is crucial for securing accurate coverage. One key form in this process is ACORD 140 – Property Section, which provides insurers with detailed information about a building and its risk factors. This form plays a vital role in determining coverage limits, underwriting decisions, and premium calculations.

Whether you’re a business owner, insurance agent, or underwriter, understanding ACORD 140 is essential for ensuring the right level of protection for commercial properties. This article will break down its purpose, key sections, and best practices for completing it accurately.

What Is ACORD 140?

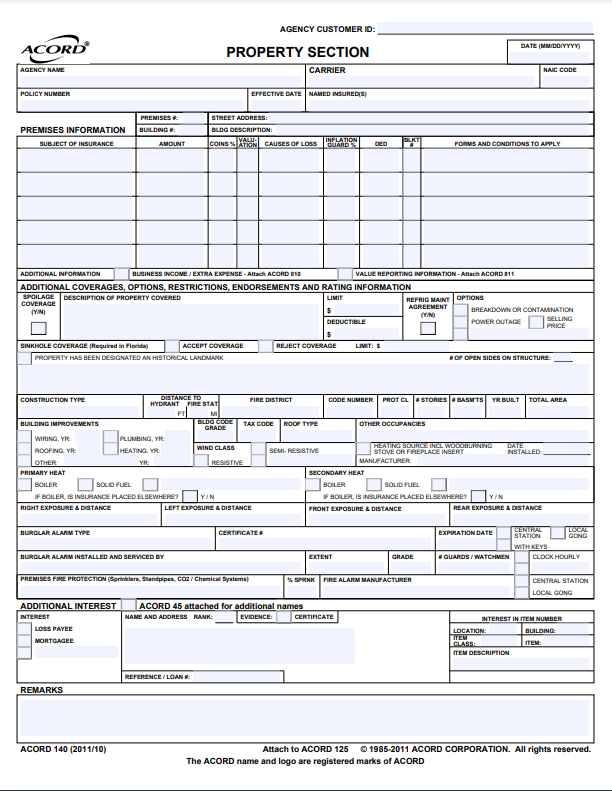

ACORD 140 is a standardized insurance form used in commercial property applications. It collects important details about the insured property, including its physical characteristics, occupancy type, protection features, and coverage requests. The form helps insurers assess the risk associated with a building and determine appropriate coverage terms.

Given that the global commercial property insurance market was valued at $254.9 billion in 2022, the demand for accurate and comprehensive documentation, such as ACORD 140, is critical to ensuring proper risk assessment and coverage. This document is often used alongside ACORD 125 – Commercial Insurance Application, which provides general business information, and other ACORD forms that specify additional coverage needs.

Key Sections of ACORD 140

ACORD 140 includes multiple sections designed to capture critical property details. Here’s a breakdown of the key sections:

Property Information

This section includes the insured’s name, policy number (if applicable), and the property’s location. It ensures insurers have precise details about the property being insured.

Building Details

The form requires specifics about the building’s size, age, construction type, and occupancy. Information about structural materials, number of stories, and fire protection features is also included to help assess risk.

Coverage Limits

This section outlines the requested insurance limits for different types of coverage, such as building, business personal property, and loss of income coverage. Accurate values are essential to avoid underinsurance or overpaying for coverage.

Protection Features

The form collects details on fire alarms, sprinklers, security systems, and other safety measures in place. These factors can influence insurance premium costs and eligibility for certain policies.

Risk Characteristics

ACORD 140 captures potential risk factors, such as the presence of hazardous materials, the property’s proximity to fire stations, and flood zone classifications. Insurers use this data to assess potential liabilities.

When Is ACORD 140 Used?

ACORD 140 plays a crucial role in the commercial property insurance process, ensuring that insurers have accurate and up-to-date information about a property. This form is required in several key scenarios where property coverage needs to be established or modified. Common situations where ACORD 140 is used include:

- Purchasing or renewing commercial property insurance – Businesses must provide property details when securing a new policy or renewing an existing one.

- Updating property details after renovations or expansions – Any structural changes, additions, or improvements must be reported to ensure proper coverage.

- Adjusting coverage limits due to changes in business operations – Expanding inventory, upgrading equipment, or modifying building usage may require updated coverage limits.

- Meeting lender or contractual insurance requirements – Banks, landlords, and business partners often require proof of adequate property insurance before approving agreements.

By accurately completing ACORD 140, businesses and insurance professionals ensure that policies align with the property’s true risk profile, preventing coverage gaps or disputes.

Best Practices for Completing ACORD 140

To ensure a smooth underwriting process and accurate coverage, follow these best practices when completing ACORD 140:

- Provide precise property details to avoid coverage gaps or miscalculations.

- Verify construction and safety information to ensure eligibility for potential premium discounts.

- Work with an experienced insurance agent to confirm all required information is included.

- Review policy limits carefully to prevent underinsurance or unnecessary coverage costs.

Following these steps helps businesses secure appropriate property coverage while minimizing the risk of policy issues or claim disputes.

Conclusion

ACORD 140 is a vital tool in commercial property insurance, ensuring that insurers have the necessary details to assess risk and provide appropriate coverage. Properly completing this form helps businesses secure adequate protection and avoid coverage issues.

By understanding its purpose and key sections, insurance professionals and business owners can navigate the property insurance process more effectively. Our insurance back office outsourcing services can streamline this process by handling ACORD 140 and related documents, ensuring accurate applications and efficient operations so businesses can focus on their core activities.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.