In the fast-paced world of insurance, documentation can make all the difference between a smooth transaction and a costly delay. One of the key documents that often comes up in property-related contracts is the ACORD 28. Whether you’re involved in real estate, construction, or commercial ventures, understanding the role of this form is crucial for ensuring that your property is properly covered.

While it may seem like a small detail, its impact on risk management, compliance, and the smooth flow of business operations cannot be underestimated. In this article, we’ll explore the purpose and significance of the ACORD 28, and how it serves as a crucial tool in managing insurance verification for property coverage.

What Is ACORD 28?

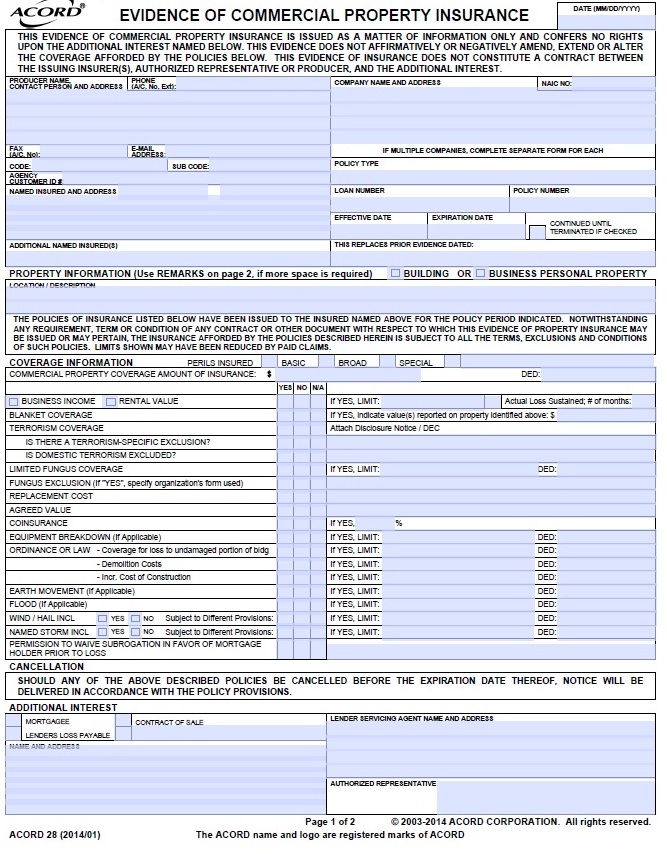

The ACORD 28 form is a standardized certificate that provides evidence of property insurance coverage. It is a verification document that assures the certificate holder—often a landlord, lender, or business partner—that the property in question is covered.

The form typically includes details about the insurance provider, the policyholder, and the insurance policy’s coverage limits. Although it is commonly used in real estate, construction, and commercial transactions, the ACORD 28 is applicable in any situation where proof of property insurance is required.

Key Information on ACORD 28

The ACORD 28 form serves as a vital document that provides all relevant parties with the details needed to confirm and understand the scope of property insurance coverage. Below is a breakdown of the key information typically included on the form:

Insurance Company Name

This section identifies the insurer providing the property coverage. It ensures that all parties are aware of who is responsible for the policy and can be contacted if needed for claims or inquiries.

Policy Number

The policy number is a unique identifier for the insurance coverage. It allows all parties to quickly reference and verify the specific policy under which the coverage is provided.

Type of Coverage

This specifies the type of property coverage in place, such as general property, commercial liability, or specialized coverage types. Understanding the type of coverage helps parties know the scope of protection and how it applies to their interests.

Named Insured

The named insured refers to the property owner or business entity that holds the insurance policy. This section ensures that the correct individual or organization is identified as the insured party in the policy.

Certificate Holder

The certificate holder is typically a third party requesting proof of insurance, often a client, business partner, or lender. This helps parties involved in transactions verify that the insurance coverage is active and meets the requirements.

Cancellation Notice

This clause ensures the certificate holder is notified if the insurance policy is canceled or modified. It prevents gaps in coverage and ensures that all parties are promptly informed of any changes that could affect their interests.

The ACORD 28 ensures transparency by outlining key details about insurance coverage, helping all parties stay informed and protected.

When Is ACORD 28 Used?

ACORD 28 is most commonly used in situations where property insurance verification is required by a third party. For example, landlords may request this form from tenants to confirm that their property is covered by insurance.

In commercial real estate or construction, the ACORD 28 provides reassurance to all parties that property coverage is in place, especially when multiple businesses or contractors are involved.

Lenders may also ask for this form as part of the loan approval process to ensure the collateral is adequately protected. In all these cases, the ACORD 28 helps streamline business transactions by providing quick and easy proof of insurance.

Considerations for ACORD 28

Although the ACORD 28 is an essential document for verifying property insurance coverage, businesses should keep in mind several important considerations to ensure its accuracy and effectiveness. Here are the key points to remember:

- Accuracy of information: The information on the form must be precise. Any errors or omissions, such as incorrect policy numbers or coverage details, can lead to delays, disputes, or invalid documentation.

- Exclusions not included: The ACORD 28 does not outline policy exclusions, which can only be found in the full insurance policy document. It’s important to refer to the complete policy for exclusions.

- Monitoring coverage: While the form includes a cancellation notice, businesses must proactively monitor their insurance coverage to ensure it remains active. Relying solely on the cancellation clause could lead to unintentional gaps in coverage.

By keeping these considerations in mind, businesses can use the ACORD 28 effectively while avoiding common pitfalls that could disrupt their insurance verification process.

Conclusion

The ACORD 28 form serves as an important tool for verifying property insurance coverage. It ensures that businesses, landlords, lenders, and other stakeholders have the necessary protection in place for property-related transactions. Understanding how to effectively use the ACORD 28 can help streamline business operations and reduce risks associated with property damage or liability.

By choosing our insurance agency back office support, you can improve the management of critical documents like the ACORD 28, ensuring accurate and timely updates for smoother operations.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.