Homeowners insurance plays a critical role in protecting property owners against unexpected financial losses caused by natural disasters, theft, and other perils. Understanding the latest statistics and industry trends can help homeowners make informed decisions about their coverage.

Homeowners Insurance Coverage Overview

As of 2023, 88% of homeowners in the U.S. had an active home insurance policy. While not legally required like auto insurance, mortgage lenders often mandate coverage. The cost of homeowners insurance depends on various factors, including location, property value, and claims history.

The average cost of home insurance in the U.S. is $2,304 per year for $300,000 in dwelling coverage, but rates can vary significantly by state due to climate risks, market conditions, and insurance regulations.

Homeowners Insurance Claims: Frequency and Causes

Claim Frequency

- 5.5% of insured homes had a claim in 2022, slightly up from 5.3% in 2021.

- Nearly 97.8% of homeowners insurance claims in 2022 were related to property damage.

Most Common Causes of Claims (2018-2022)

| Cause of Property Loss | 2018 | 2019 | 2020 | 2021 | 2022 |

| Wind & Hail | 40.5% | 38.3% | 48.3% | 39.8% | 40.7% |

| Fire & Lightning | 25.4% | 21.1% | 21.1% | 23.3% | 21.9% |

| Water Damage & Freezing | 24.0% | 29.0% | 19.6% | 23.4% | 27.6% |

| Theft | 1.0% | 1.0% | 0.6% | 0.7% | 0.7% |

| Other Property Damage | 6.5% | 7.2% | 7.6% | 9.8% | 6.9% |

Wind and hail damage consistently remain the leading cause of homeowners insurance claims, followed by water damage and freezing.

Claim Severity and Payouts

- The average homeowners insurance loss per claim from 2018 to 2022 was $15,747.

- Fire and lightning claims resulted in the highest payouts, averaging $83,991 per claim.

- While liability insurance claims are less frequent (only 0.09% of all claims), they tend to be costly, averaging $26,175 per claim between 2018 and 2022.

Homeowners Insurance Premium Trends

Annual Premium Changes (2018-2022)

| Year | Average Claim Severity |

| 2018 | $14,579 |

| 2019 | $14,090 |

| 2020 | $15,053 |

| 2021 | $16,801 |

| 2022 | $18,311 |

Homeowners insurance costs have been increasing due to inflation, rising construction costs, and more frequent natural disasters. The average premium rose by 7.6% in 2021 from 2020.

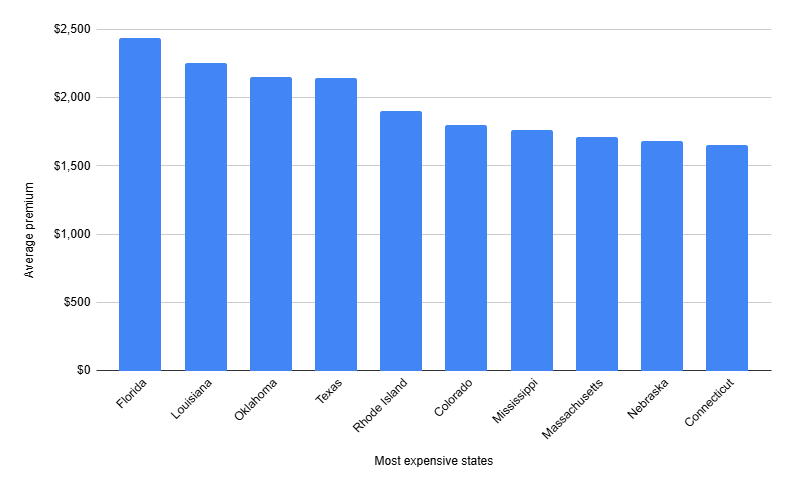

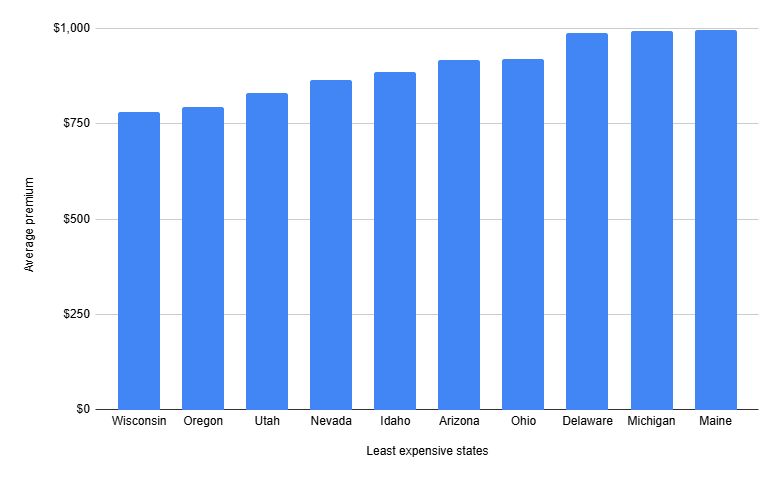

Most and Least Expensive States for Homeowners Insurance (2021)

Most Expensive States

- Florida – High hurricane risk, litigation costs, and insurer withdrawals.

- Louisiana – Prone to hurricanes and flooding.

- Texas – Rising severe storm and winter weather damage.

Least Expensive States

- Wisconsin – Minimal weather-related risks.

- Oregon – Lower exposure to extreme weather events.

- Utah – Fewer high-risk property damage claims.

Homeowners Insurance by Provider

Home insurance rates also depend on the insurance company. Some of the biggest insurers and their average rates for $300,000 in dwelling coverage are:

| Insurance Company |

Average Annual Premium |

| USAA | $1,451 |

| Auto-Owners | $1,696 |

| American Family | $1,698 |

| Erie Insurance | $1,871 |

| State Farm | $1,984 |

| Allstate | $2,289 |

| Farmers | $2,672 |

| Travelers | $2,448 |

| Chubb | $3,567 |

Regional and Industry Trends Impacting Homeowners Insurance

Florida and California – Insurance Crises

- Florida’s home insurance market is in turmoil due to hurricanes and high litigation costs. Several insurers, including United Insurance Holdings Corp., Southern Fidelity, and Weston Property & Casualty, have exited the state or gone bankrupt.

- California faces a wildfire crisis that has led State Farm, Allstate, and Farmers to limit new homeowner policies. Proposition 103 restricts insurers from adjusting rates based on modern wildfire risk models, complicating their financial viability.

Texas – Emerging Insurance Issues

- Texas is seeing a surge in insurance company withdrawals, with Foremost and Progressive halting new policies and non-renewing existing ones due to hurricanes and winter storms.

How Homeowners Can Save on Insurance

Shopping around for the best rates, bundling policies, and making strategic home improvements can help homeowners reduce their insurance costs while maintaining adequate coverage. Here are some effective ways to save:

- Compare Multiple Quotes – Rates can vary significantly between insurers.

- Bundle Home and Auto Policies – This can lead to discounts of up to 25%.

- Increase Your Deductible – A higher deductible often results in lower premiums.

- Upgrade Your Home’s Safety Features – Reinforcing roofs, adding storm shutters, and installing security systems can reduce risks and lower insurance costs.

By understanding the factors that influence home insurance costs and taking proactive steps to mitigate risks, homeowners can secure reliable coverage while keeping expenses manageable.

Conclusion

The homeowners insurance market is facing rising premiums, increased claims severity, and shifting industry dynamics. With climate change and insurer withdrawals reshaping the landscape, staying informed is crucial for homeowners looking to secure reliable coverage at an affordable price.

By understanding key trends, risks, and cost factors, homeowners can make better decisions when selecting policies and ensuring their financial protection against unforeseen damages.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.