Healthcare providers or organizations require adequate compensation for the services they provide. One way to ensure this is through claim submission. But what is claim submission in medical billing?

Read on as we explore the importance of the claim submission process in the healthcare revenue cycle.

What Is a Claim in Medical Billing?

The bill that medical professionals send to a patient’s insurance company is called a medical claim. Claims are crucial in a healthcare organization’s revenue cycle.

Claims include distinct medical codes that describe the treatment provided during a visit with a patient. A claim must include the following details:

- Patient Information

- Insurance provider details

- Service codes

- Billing information

Insurance providers or companies evaluate all of the information included in a claim according to medical codes. They do this to decide how much the insurance company will pay the healthcare provider or organization for services rendered.

Due to the complexity of the medical codes and to ensure each claim’s acceptance by the provider, most healthcare organizations outsource medical billing processes.

With our expert knowledge and experience in the medical and insurance sector, we offer tailored solutions to healthcare providers at CLICKVISION BPO. We offer you customizable services to meet your unique requirements.

Source: neolytix.com

What Is Claim Submission in Medical Billing?

Claim submission in medical billing is vital to ensure healthcare providers receive payment for the services they provide.

Examining the claim data before sending the claims to insurance companies is known as the “claims submission process.” Claims must be submitted in a timely manner and with the correct details to ensure the insurance company doesn’t reject them.

To verify the accuracy of the data, we make use of the features provided by the practice management systems. Before submitting the work to the insurance payers, we fix the common reasons for rejections and make the necessary corrections.

One of the most important sources of information for healthcare businesses is medical claims.

Electronic Claim Submission

Claim submission may be done both manually and electronically. Between the two, electronic claim submission is a more streamlined method with better accuracy. By submitting claims electronically, your organization may get its reimbursement faster.

For electronic healthcare claim submission, we use the standard ANSI 837 format. The ANSI (American National Standards Institute) 837 format allows our team and healthcare professionals in general to submit healthcare claims electronically.

By incorporating a standardized format it ensures that across the entire healthcare industry, the data sharing is:

- Accurate

- Consistent

- Efficient.

Key Components of Claim Submission

To provide an accurate and comprehensive representation of healthcare services, several components need to be included.

Patient Information

The initial stage in the claim submission process is registering accurate patient information. The personal information and insurance details of the patient must be accurate and up-to-date on the claim submission to ensure efficent verification. If the information is incorrect, the insurance provider will reject the claim. The information needed is:

- Patient’s name

- Patient’s date of birth

- Patient’s insurance information

- Patient’s contact details

Insurance Eligibility Verification

The healthcare professional is required to confirm the patient’s insurance after they are registered. This makes it easier to verify that the patient has sufficient insurance to cover the care they will get.

Verification assists healthcare providers in evaluating the following and determining coverage and eligibility:

- What benefits does the patient’s insurance policy have?

- Whether a person has a balance of out-of-pocket, deductible, or co-pay costs.

- Whether the patient’s insurance provider requires pre-authorization for certain procedures.

Medical Coding

One crucial step that follows the provision of care is medical coding. Standardized medical codes are created by healthcare providers using their notes and other clinical documentation.

Among the most often used medical coding schemes are the following:

- Diagnosis Related Group (DRG)

- Current Procedural Terminology (CPT)

- Healthcare Common Procedure Coding System (HCPCS)

- International Classification of Diseases (ICD-10)

- National Drugs Code (NDC)

Healthcare professionals utilize these codes to specify the diagnoses, treatments, medications, and supplies they have provided, along with the reason for the same. The specificity of medical codes aids in describing the patient’s condition to insurance providers and their necessity.

Transmission of Claims

The process of transferring claims from the caregiver to the payor is known as claims transmission. Prior to being sent to the payor, medical claims are reviewed and reformatted for accuracy.

Finalization

After the payor receives a medical claim, adjudication takes place. After assessing the claim, the payor determines the validity of the medical claim as well as the reimbursed amount.

They will repay the provider and bill the patient for any unpaid balance if the claim is approved. The payor may reject the claim if the patient’s insurance coverage doesn’t cover pre-authorization for a certain service.

If a payor rejects a medical claim, the patient or the billing company might need to resubmit it with the necessary documentation to have the costs of healthcare services covered. The payor may also deny a claim.

This occurs when there is a charge entry problem, the wrong documentation is submitted, or a medical coding error in the claim. Medical claims that are denied can be appealed for reimbursement when the mistakes are fixed.

Importance of Accurate Claim Submission

For a claim submission to be efficient, all the information, patient data, and medical codes must be accurate. If any of the data in the submitted claim is incorrect or incomplete, the clearinghouse will reject the claim.

However, accurate claim submission leads to the following:

- Timely reimbursement

- Reduced denials

- Improved revenue cycle management

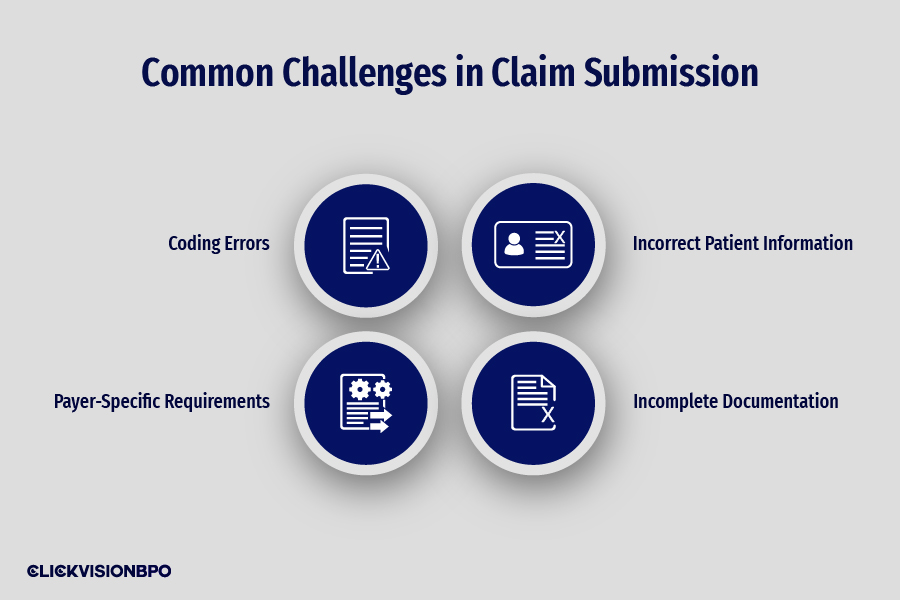

Common Challenges in Claim Submission

Even if you try to be on top of your game, errors and challenges regarding claim submission could happen. To prevent such issues, we will elaborate on how to identify and rectify the challenges you may encounter.

Coding Errors

These can include errors such as assigning the wrong code or not including crucial modifiers. Coding errors may lead to claim denials, underpayment, or delays in reimbursement. This is because insurance providers rely on accurate medical codes to determine the reimbursement amount.

Incorrect Patient Information

Misspelled names and outdated insurance information are among the most common errors in claim submission. These types of errors could result in claim denials as the insurance company won’t be in a position to verify the patient’s credentials within their database.

Incomplete Documentation

Not including all the necessary information is a significant error that can cause your claim to be denied. Incomplete documentation makes it difficult for the insurance company to verify the medical necessity of the healthcare services provided.

Payer-Specific Requirements

Every insurance company has its own policies and guidelines that you must follow during claim submission. Failing to meet the payer-specific requirements may result in claim rejections or delays. If this occurs, you will need to resubmit the claim once you’ve fixed the initial errors.

Best Practices for Effective Claim Submission

The best practices for effective claim submission include ensuring the following:

- Accurate patient information – when submitting a claim, ensure that the patient demographic, insurance coverage, and policy details are validated. Accurate information helps in minimizing claim denials or processing delays.

- Timely claim submission – submit each claim within its specified timeframe to ensure you receive payment for the healthcare services you provide.

- Regular submitted claim follow-up – ensure regular follow-up on submitted claims to track their progress and to address any issues regarding incorrect or insufficient information.

Regulatory Considerations in Claim Submission

All claim submissions must be HIPAA (Health Insurance Portability and Accountability Act) compliant, as this regulation ensures the privacy and security of patients’ information.

Both health providers and insurance companies must follow HIPAA guidelines when handling electronic claim submissions to ensure patient confidentiality.

Moreover, healthcare and insurance providers must implement security measures to prevent false claims and unethical billing practices. Implementing compliance programs and regular audits aid in detecting fraud in claim submissions.

Conclusion

What is claim submission in medical billing? In short, claim submission is the process of submitting claims to insurance providers to receive payment for provided healthcare services.

Each claim you submit must be accurate and efficient. This is exactly what we ensure at CLICKVISION BPO. Our clients can rest assured that all of their claims are accurately and efficiently submitted.

Don’t have the time to follow the guidelines? Outsource medical billing to a billing expert. You can partner with a reliable billing company, like CLICKVISION BPO, to overcome your medical billing and coding challenges.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.