Insurance verification is a vital part of the medical billing sector. It allows healthcare providers to confirm their patients’ insurance coverage and benefits. So, why is insurance verification important in the healthcare industry?

Our partnership with healthcare brands and organizations provides us with expert knowledge on the importance of this step in medical billing.

Read on as we explore further the process of verifying patients’ eligibility for insurance coverage and benefits.

Understanding Insurance Verification

Insurance verification in medical billing is the initial step in the process of confirming that a patient has insurance coverage for the care and services they are about to receive from a healthcare provider.

The insurance eligibility verification is a pretty complex process that requires attention to detail. Since insurance health claims can be easily manipulated, it is within the insurance verification process to verify accurate and up-to-date information, further minimizing claim denials or even fraud.

As an outsourcing company, we oversee the insurance verification process for our clients while they focus on providing care to their patients and other core responsibilities.

Our insurance verification services process involves the following:

- Patient information gathering

- Contacting the insurance companies

- Benefits verification

- Record keeping and documentation

Patient Information Gathering

The first step in insurance verification is gathering comprehensive information about the patient, including the following:

- Personal details (name, date of birth, address, and SSN)

- Insurance ID

- Insurance policy number

- Insurance group ID

Contacting Insurance Companies

Once we gather the necessary patient details and demographic data, we reach out to their insurance provider. We do this to verify the status of the patient’s insurance coverage.

During this step, we confirm the following:

- The insurance policy’s active status

- Coverage type

- Effective dates

- Associated copays and deductibles

Benefits Verification

As part of the insurance verification, it is also important to verify the benefits of the patient’s coverage. With benefits verification, healthcare providers determine which medical services and treatments their patients’ insurance covers.

This includes:

- Office visits

- Diagnostics tests

- Procedures

- Prescription medications

Record Keeping and Documentation

For all the personal details and verified insurance information we gather, we keep records and maintain detailed documentation for future reference. The verified insurance details help streamline future medical billing.

It is also crucial to regularly update the patient records as insurance coverage may change due to

- Revisions in patient insurance revisions

- Provider networks

- Policy terms

Source: freepik.com / Photo Contributor: rawpixel.com

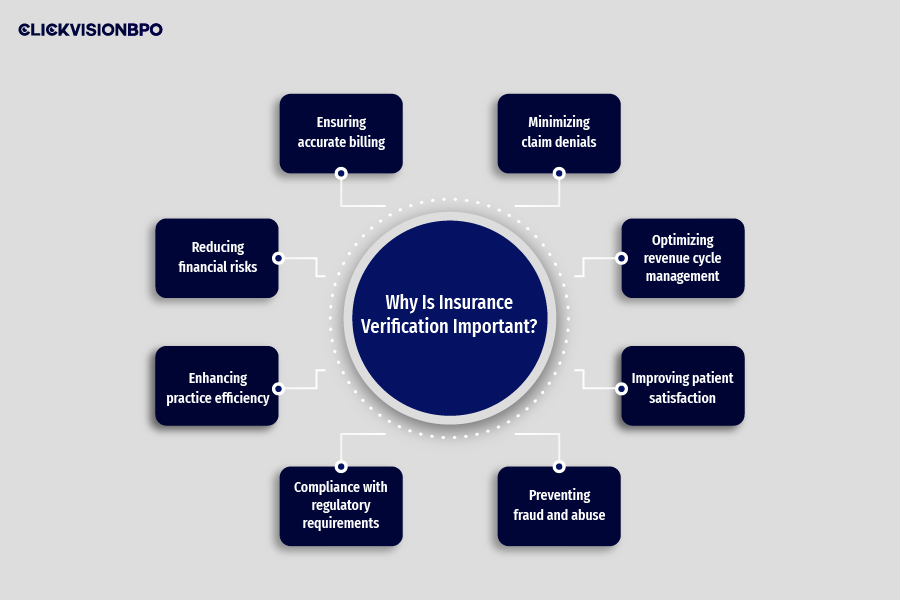

Why Is Insurance Verification Important?

Insurance verification is a vital step in revenue cycle management. The entire process circulates around verifying the patient’s insurance coverage and the benefits while ensuring that healthcare services are properly billed and reimbursed..

Insurance verification is essential for the following reasons in healthcare:

- Ensuring accurate billing

- Minimizing claim denials

- Optimizing revenue cycle management

- Improving patient satisfaction

- Preventing fraud and abuse

- Compliance with regulatory requirements

- Enhancing practice efficiency

- Reducing financial risks

Ensuring Accurate Billing

Insurance verification allows healthcare providers and organizations to ensure accurate billing. As a healthcare provider, you will have exact insight into the patient’s financial obligations, including co-payments and deductibles.

With accurate billing, you minimize errors and any out-of-pocket surprise charges to your patients. If there are errors in the claims, the insurance company is likely to reject them.

This means healthcare providers will need to recheck and resubmit the claim with the provider again.

Minimizing Claim Denials

In order to ensure healthcare providers get reimbursement for their services, it is crucial to minimize claim denials. If claims get rejected by insurance companies due to inaccurate or missing information, the entire process of submitting a claim must be repeated, which could result in a loss in revenue.

Therefore, it’s important that during the insurance verification process, healthcare providers review the claims and ensure everything is in perfect order.

Optimizing Revenue Cycle Management

Insurance verification is vital in maintaining a healthcare organization’s revenue cycle and ensuring financial security. Naturally, for a healthcare organization or brand to keep growing, they need continuous cash flow.

This means you need to get reimbursement for the care provided to patients to ensure an optimized revenue cycle. By optimizing your revenue cycle management, you ensure an uninterrupted medical billing process.

Healthcare providers may reinvest the revenue in their practices by expanding facilities or purchasing new medical equipment to enhance the quality of their healthcare services.

Improving Patient Satisfaction

Verifying patients’ insurance beforehand reduces the likelihood of them receiving out-of-pocket surprise expenses. This improves their satisfaction with the healthcare provider.

To make the process easier and offer a smooth experience to patients, we, and many others, have implemented electronic, instantaneous verification. Prompt confirmation reduces procedural delays. This lowers the obstacles to care and enables patients to budget for their healthcare better.

Patients immediately learn about all of the following things:

- Multiple visit coverage under insurance

- Benefit limits

- Copay

- Deductible

- Unforeseen costs

Preventing Fraud and Abuse

Verifying insurance also has a preventative purpose. Insurance claim denials brought on by inaccurate or lacking information might cause delayed revenue. Or, worst case scenario, loss in revenue.

Insurance verification assists in the detection of possible issues that may be the cause of claim denials. Timely resolution of these problems minimizes claim rejections, increases reimbursement rates, and ensures financial stability.

Compliance with Regulatory Requirements

During insurance verification, healthcare providers or organizations must ensure they comply with all the regulatory requirements. This includes following all applicable laws in the healthcare industry (local, state, and federal) to avoid legal issues.

Regulations like the Health Insurance Portability and Accountability Act (HIPAA) are vital to comply with as they ensure the patients’ privacy and safety. The regulatory requirements and laws are essential to:

- Protect patient privacy

- Ensure data security

- Establish guidelines for insurance coverage and claims processing

It is crucial for everyone working in the healthcare industry to stay up-to-date with the latest industry standards and changes in regulations. This allows them to adjust healthcare processes accordingly to ensure they comply with the laws and avoid any legal issues.

Enhancing Practice Efficiency

Healthcare administration departments are burdened with billing, coding, insurance information, and denied claims. A large portion of this human processing is eliminated by electronic insurance verification.

This increases the likelihood of submitting error-free claims on the first try. Using verification software and EHR (electronic health records) systems, healthcare organizations may ensure a considerable improvement in revenue cycle time, denial rates, and reimbursements.

Reducing Financial Risks

Financially, delayed verification disrupts healthcare organization’s streamlined workflows. Healthcare providers will incur more costs the longer it takes to process a claim.

Healthcare providers that have delayed or denied claims may have to pursue patient payment long after the care was provided. This may negatively affect not only your revenue cycle but also patient satisfaction with your services.

Timely insurance verification improves cash flow and financial stability by reducing expenses, speeding up reimbursements, and reducing denials. This raises revenue, improves operations and efficiency, improves patient satisfaction, and lowers financial risks.

Conclusion

Why is insurance verification important? Insurance verification is a crucial step in revenue cycle management for healthcare providers, brands, or organizations. As a healthcare provider, insurance verification may help you ensure accurate billing and futher minimize claim denials.

With insurance verification, you may check the patient’s ability to cover the services and care you provide ahead of time. It also allows you to see which healthcare services your patient is eligible for to minimize their out-of-pocket costs.

Don’t have the time to follow our guidelines? Outsource insurance verification to billing experts. You can partner with a reliable billing company, like CLICKVISION BPO, to overcome your insurance verification challenges.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.