Renters insurance provides financial protection for tenants by covering personal belongings, liability risks, and additional living expenses in case of theft, fire, or other covered losses. While not required by law, many landlords mandate it as part of lease agreements.

Understanding key trends and statistics in renters insurance can help renters make informed decisions about their coverage. By staying updated on these figures, tenants can better navigate pricing, coverage options, and regional differences that affect their insurance needs.

Renters Insurance Coverage Overview

In 2020, 57% of renters in the U.S. have renters insurance, a significant increase from 31% in 2012. While this shows growing awareness, millions of tenants remain uninsured, leaving their personal property unprotected.

Unlike homeowners, renters are not covered under a landlord’s insurance policy. A landlord’s policy only protects the structure of the building, meaning tenants must rely on renters insurance to cover their personal belongings, liability, and additional living expenses in case of displacement.

The average cost of renters insurance in the U.S. was $170 per year ($14 per month) in 2021. However, rates vary by state due to factors like crime rates, natural disasters, and coverage limits.

Renters Insurance Premiums by Year (2012-2021)

| Year | Average Premium | Percent Change |

| 2012 | $187 | – |

| 2013 | $188 | +0.5% |

| 2014 | $190 | +1.1% |

| 2015 | $188 | -1.1% |

| 2016 | $185 | -1.6% |

| 2017 | $180 | -2.7% |

| 2018 | $179 | -0.6% |

| 2019 | $174 | -2.8% |

| 2020 | $173 | -0.6% |

| 2021 | $170 | -1.7% |

Over the past decade, renters insurance premiums have steadily decreased due to market competition and a reduction in overall claim frequency.

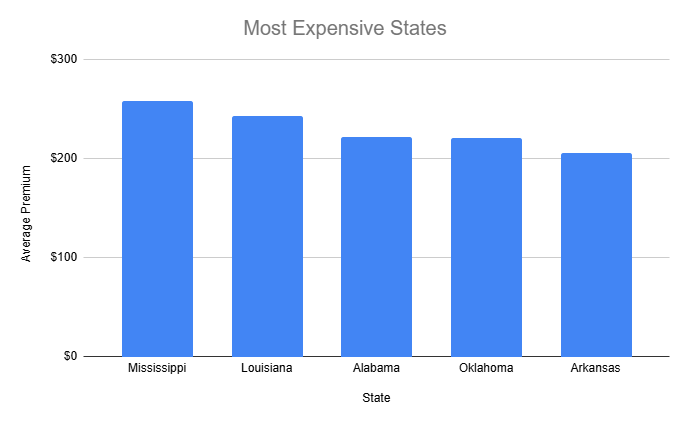

Most and Least Expensive States for Renters Insurance (2021)

Most Expensive States

Renters in Mississippi, Louisiana, and Alabama pay the highest premiums due to high exposure to hurricanes, flooding, and tornadoes.

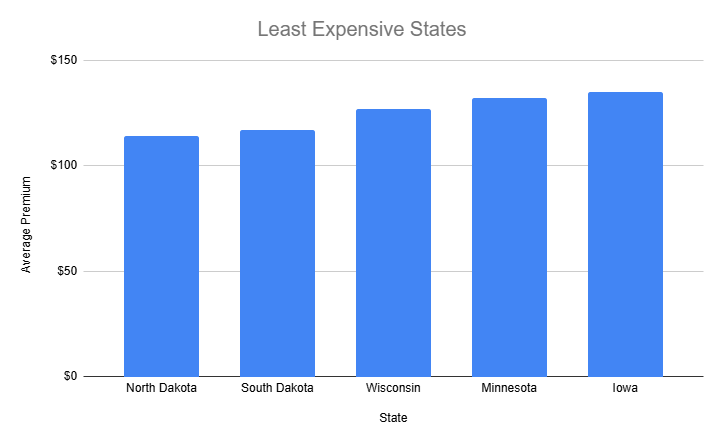

Least Expensive States

Lower crime rates and fewer natural disaster risks contribute to cheaper renters insurance in North Dakota, South Dakota, and Wisconsin.

Percent of Income Spent on Rent and Utilities (2022)

With rising housing costs, many renters struggle to afford both rent and insurance. In 2022, 48.2% of renters in the U.S. spent 30% or more of their income on rent and utilities, classifying them as cost-burdened.

States Where Renters Spend the Most on Housing

| Rank | State | % of Renters Spending 30%+ on Rent & Utilities |

| 1 | Florida | 57.9% |

| 2 | Nevada | 54.0% |

| 3 | California | 53.3% |

| 4 | Hawaii | 52.1% |

| 5 | Colorado | 50.7% |

States with high housing costs, like Florida, Nevada, and California, have the largest percentage of renters struggling with housing affordability.

Factors Influencing Renters Insurance Premiums

Several factors impact renters insurance costs, including:

- Location – High-risk areas (e.g., hurricane zones) have higher premiums.

- Coverage Limits – Policies with higher personal property limits cost more.

- Deductibles – Higher deductibles lower premiums but increase out-of-pocket expenses during a claim.

- Building Type – Older buildings with outdated wiring and plumbing have higher premiums.

- Crime Rates – Neighborhoods with high theft and vandalism rates see increased insurance costs.

Renters Insurance Common Claims

Renters insurance covers various claims, including fire, theft, and water damage. The most common claims include:

- Theft – Protection against stolen personal belongings.

- Fire & Smoke Damage – One of the most expensive claims, covering the cost of damages caused by fire and smoke.

- Water Damage – Coverage for damage due to burst pipes or leaks, though not for flooding.

- Liability – Protection for injuries that occur within the rental unit.

While the typical renters insurance claim can vary, more severe cases may lead to higher payouts depending on the situation.

Conclusion

Renters insurance remains an affordable way to protect personal belongings and liability risks. While the average premium has declined in recent years, regional risks and economic factors continue to influence insurance costs.

As rental demand grows and climate-related risks increase, renters should evaluate their coverage needs carefully to ensure adequate financial protection.

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.