Healthcare facilities are opened to provide patients with medical services, but also to generate cash flow. Reports are key indicators of how financially successful your organization is. One of the most important is the insurance aging report.

In the revenue cycle management of every healthcare provider, big or small, understanding how to read and interpret the aging report is vital. So, if you are a stakeholder or part of the management team of a healthcare facility, our expert guide will provide you with all the information you need to use the data.

What Is an Insurance Aging Report?

Every healthcare provider should review the revenues and expenses on a regular basis. The billing process in the healthcare industry is unique. The insurance aging report is a rather important financial document because of the industry’s nature and the entire medical billing process.

The aging report is a periodic report that includes all the outstanding insurance balances. It is a detailed overview of the accounts receivable, which is the amount that insurance companies or patients owe to the healthcare facility for the services the patient already has.

Consequently, the aging report can also be referred to as an accounts receivable aging report. Generating such a report requires a lot of expertise and dedication.

Source: freepik.com / Photo Contributor: jcomp

Insurance Aging Report in Medical Billing

A medical billing team is responsible for handling many aspects of the revenue cycle management. Generally, they manage all the payments a healthcare provider should get for the care they have given to their patients.

For successful management of all payments, regular updating of the aging report is required. The aging report in medical billing gives billers insights into where a follow-up on unpaid claims is needed and allows them to minimize the number of unpaid claims.

In addition to medical billers, the aging report provides valuable insights for the management sector and all current and potential stakeholders. The aging report mirrors the financial health and stability of a medical practice.

Moreover, it identifies overdue payments, denials, and all pending claims. The aging report in medical billing is one of the indicators of the financial health of healthcare organizations and the capability to effectively manage payments. All in all, aging reports are important for:

- Payment tracking

- Cash flow management

- Identifying payment patterns

- Avoiding bad debts

- Improving customer relationships

Key Components of an Insurance Aging Report

Unfortunately, there is no standardized insurance aging template. The layout of the aging report is typically organized according to the organization’s needs. Nevertheless, all comprehensive aging reports should have at least the following key components:

- Patient and payor information

- Invoice details

- Invoice amount

- Current amount due

- Aging categories

- Total amount due

- Total amount outstanding

Source: freepik.com / Photo Contributor: user4894991

Patient and payor information

This is a short part of the aging report in medical billing including all the patient’s important personal and contact details. Also, in a separate column, the information about the insurance company or person who is responsible for paying for the services should be listed.

Invoice details

The next important component in the aging report is the invoice details. It should contain different data, such as the issue date and due date of the medical claim. Sometimes, a unique identifier is added, such as a claim number.

Invoice amount and current amount due

The section of invoice amount should display the cost of a patient’s healthcare services. On the other hand, the current amount due is a column dedicated to the amount that is owed for every claim.

Aging categories

The outstanding balances are categorized according to the date the claim was submitted to the insurance plan. Typically, the aging report contains 30-day groups. The segments in the insurance aging report have the following meanings:

- Current accounts receivable: All claims that are not past their due date.

- 1-30 days: Claims that are between one and thirty days past their due date.

- 31-60 days: Claims that are 31 to 60 days overdue.

- 61-90 days: Claims that still haven’t been paid 61 to 90 days after their due date.

- Over 90 days.

Some aging reports also have a separate section, including already-paid claims. The claims are divided and listed according to the A/R days, which are the number of days the payor needs to pay the claim. Typically, they are also divided into 30-day brackets.

Total amount due and total outstanding

The total amount due is calculated by adding the outstanding balances in each category. On the other hand, the total outstanding is a sum of all claims that need to be paid from all categories in the aging report. Typically, the total amount due and the total outstanding category are what interests stakeholders and people in management positions.

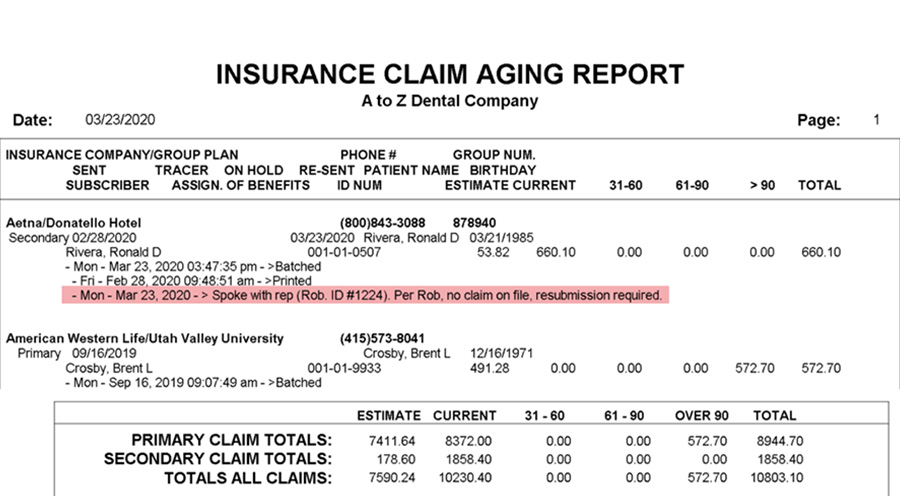

Source: easydental.com

Benefits and Limitations of Aging Reports

Insurance aging reports, along with denial, payment posting, adjustments, and provider productivity reports, play a crucial role in revenue cycle management. First and foremost, an aging report might help your organization with cash flow optimization by identifying overdue accounts.

Aging reports make it easy to stay on top of unpaid bills and minimize the chances of revenue setbacks. Additionally, aging reports can be indicators of bad debt, so proper financial measurements can be taken before it is too late.

Next, if the data from the aging report is used wisely, it might help you forecast future revenue trends. More specifically, if you decide to outsource your medical billing, our experienced team may anticipate any drastic fluctuations in your revenue in a timely manner.

However, aging reports also have certain limitations. One of the biggest drawbacks of aging reports is that they must be constantly updated so they can show the actual financial situation of the health organization.

Conclusion

If you are running a healthcare facility, the insurance aging report will be one of the most important documents when it comes to finances. By using the valuable data the aging report has, you can improve your cash flow.

Nowadays, more and more healthcare facilities decide to outsource their accounts receivable services, and their entire medical billing process. At CLICKVISION BPO, your facility can outsource your medical billing with ease.

Contact our medical billing experts today and see how we can assist you in having an effective payment collection process!

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.