Have you ever received a document from your insurance company after you visited the doctor? Was it filled with codes and unfamiliar terms? That is likely an Explanation of Benefits. Now, you may wonder – what is EOB in medical billing?

Such documents play a critical role in the healthcare reimbursement process. At CLICKVISION BPO, we understand their implications in healthcare. Hence, we will explore how it ensures financial clarity for patients and medical providers.

What Is EOB in Medical Billing?

Explanation of Benefits (EOB) is a document that contains comprehensive details about how an insurance company processes a claim that a healthcare provider submitted. It outlines claim adjudication and the financial responsibilities the patient has.

It depicts what was covered and what wasn’t, as well as how much you may owe (costs billed by your doctor that are not covered by your insurance plan.) This statement summarizes the services rendered, the amount the healthcare provider billed for them, and the portion covered by insurance.

The primary goal of EOBs is to ensure a smooth healthcare reimbursement process. An important thing we like to note is that this document is not a bill. However, it will help you understand the potential costs of a specific medical service. The Explanation of Benefits provides a transparent view of:

- Services provided – The document details the specific healthcare services you will receive (doctor’s visits, lab tests, or surgery).

- Provider charges – This statement section detects the amount your healthcare provider billed for the services.

- Insurance adjustments – The EOB also explains how the insurance plan ‘negotiated’ the charges with the insurance provider.

- Insurance coverage – It also clarifies how much has been covered from the allowed amount.

- Patient responsibility – The document also has a section highlighting the patient’s financial obligation after insurance coverage (deductibles, copays, and coinsurance).

EOBs in the healthcare sector

Aside from being critical documents in medical billing, EOBs serve as communication tools within the broader healthcare system. It facilitates dialogue and collaboration between patients, healthcare providers, and insurance companies.

They enable healthcare providers to track the status of the claim. These documents also informed healthcare providers to understand how insurance companies processed their claims. With these details, they can identify any discrepancies or issues that may require addressing and rectification.

EOBs also give patients a clear picture of their financial costs and inform them about their obligations. Such knowledge helps patients manage the budget for medical expenses and have a better understanding of their insurance coverage.

Additionally, EOBs allow insurance companies to communicate their coverage decisions effectively. They also enable insurance providers to inform patients and medical providers about the payment details.

Considering this, we can say that EOBs foster trust and accountability within the healthcare system.

What Does EOB Stand For in Medical Billing?

The term EOB stands for Explanation of Benefits – a statement that an insurance company issues to the policyholder. This type of document provides a detailed breakdown of how your insurance processed the claim.

This includes details such as who provided the care, how much was billed, the amount the plan covered, and how much you owe.

Hence, an EOB will help you determine what your financial responsibility may be. You will receive this type of document around the same time that you receive your patient billing statement.

It will give you a clear image of what is covered by them financially and what your remaining responsibility will be. As a result, this is a standardized term in the medical billing and healthcare reimbursement process.

Key Components of an EOB

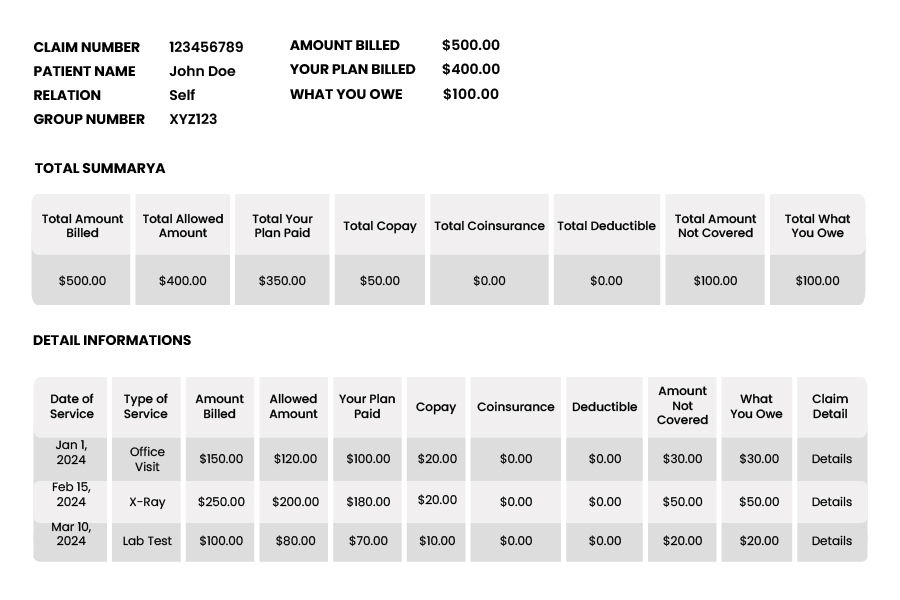

An EOB document comprises several components, elucidating claim adjudication and financial responsibility. They typically contain the following components:

- Patient information – This section identifies the patient by name and policy number. It also provides the patient’s contact information for accurate identification and correspondence.

- Details about the service – This segment specifies the services the patient received, providing clarity about the nature of care received. It includes dates of the service, performed procedures, billing codes, and descriptions.

- Insurance coverage – This portion of the document explains how much the insurance plan covers for the rendered services. It details information on deductibles (the initial amount you pay before the insurance kicks in), copays ( a fixed amount you pay for a medical service), and coinsurances (a percentage you share with the insurance company).

- Payment information – This section explains how much the insurance company paid the provider and the remaining balance the patient owed. It provides an explanation of charges, allowed amounts, and covered expenses.

- Provider contact information – The EOB may also include contact details of the healthcare provider who submitted the insurance claim. It facilitates addressing any queries or concerns regarding the claim in the billing process.

Understanding the EOB Process

Every time you use your healthcare plan to get care as a patient, you will receive information about the claim that your healthcare provider submitted. You receive the EOB, which will give you an overview of the claim.

When you receive certain healthcare services, your provider will submit a claim (services and associated costs) to your insurance company. They will then review this formal request according to your coverage and eligibility.

Once they review the claim, they will generate an EOB which explains their decision. If your plan covers the services you receive, the document will detail the approved amount and how much the insurance company will cover.

In contrast, if the services are denied, the statement will explain the reason behind the denial. Additionally, it will also discuss the necessary steps you need to take in order to appeal their decision.

Why Are EOBs Important?

The significance of EOBs in the healthcare sector cannot be overstated. One of their main advantages is the transparency they offer, allowing patients to have a clear understanding of their charges and financial responsibilities.

They also serve as a tool for verifying the accuracy of billing information. These documents give patients peace of mind, knowing they are billed correctly for the medical services they received.

The EOBs serve as a powerful tool for empowering all patients to advocate for their rights and interests. Such records allow patients to stay aware of their healthcare spending and ensure they receive the quality care they deserve.

Importance of Reviewing EOBs

An Explanation of Benefits is not something that you should toss aside. On the contrary, it is beneficial to take your time and review this document for accuracy. Such documents can contain errors or incorrect service and billing details.

Reviewing such a document will help you understand the necessary insurance and medical expenses costs, which can help you make informed decisions. You can also identify any issues and file appeals if necessary.

If you have any considerations or you are dissatisfied with the outcome, you may be able to appeal the decision. You will need to keep the bill and contact your insurance company if you have any complaints.

Common Terminology Used in EOBs

Understanding some key terms used in EOBs can help you decipher these documents more effectively. These include:

- Date of service – The specific date when you received the medical service.

- Billed amount – The amount the healthcare provider charges for each service on the claim.

- Allowed amount – This term signifies the maximum amount your insurance company is willing to pay for a specific medical service.

- Claim details – Specific messages for each claim explaining how the claim was processed.

- Type of service – The service and care the healthcare provider gives.

- Denial reason – If your service is denied, this term will explain the reason behind the denial. There can be many different reasons for not being covered by the insurance plan.

Conclusion

Having a good understanding of the EOBs is crucial for navigating healthcare services. So, what is EOB in medical billing? This document serves as a critical communication tool. It provides transparency regarding insurance coverage and informs about financial responsibility.

By taking the time to review this document, you can verify claim processing, ensure accuracy, and determine healthcare costs. All of these contribute to a successful and financially empowered healthcare experience.

With all this information, if you still find it challenging to navigate the complex medical billing landscape, why not outsource medical billing services to professionals like CLICKVISION BPO?

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.