The healthcare and insurance industries are highly regulated fields that require a thorough understanding of operational processes. Bearing the responsibility for the lives and well-being of patients, failing to comply with the strict standards might have devastating repercussions. So, what is claim processing in healthcare, and how does it affect your overall business operations?

In this article, we’ll elaborate on the use and importance of claim processing while highlighting the key components. We’ll explain the types of claims you should know and the most common healthcare coding systems.

Continue reading to discover all there is to know about claim processing, its use in the healthcare industry, and its processes!

What Is Claim Processing in Healthcare?

In simple terms, this process is responsible for obtaining all the necessary information used to determine how much the healthcare facility will be paid on a given claim. This includes multiple administrative procedures, including submitting, assessing, and paying for medical services provided to your patients.

The reason why claim processing is considered one of the most important aspects of healthcare operations is because it ensures that medical providers get compensated for their services and patients receive the high-quality care they deserve. However, since the process deals with determining the patient’s insurance coverage and benefits, it’s of utmost importance to verify the accuracy of the submitted information.

Key Components of Claim Processing

Now that you’re familiar with the use and definition of claim processing, we want to elaborate on its key components. To better understand the process, you’ll need to familiarize yourself with the following terms:

- Claim submission

- Adjudication and payment

- Denial management

Claims submission

The first key component of claim processing is submitting your claim to the designated insurance company. It acts as a request for reimbursement to the payer regarding the services offered to the patient.

Since it ensures the providers get appropriately compensated, an accurate and efficient claim submission is essential for proper revenue cycle management and timely reimbursement. Even though healthcare organizations can choose between different claim submission options, the two most common types are:

- Electronic submission through clearinghouses

- Direct submission

Source: freepik.com / Photo Contributor: pongsaksapakdee

Electronic submission through clearinghouses

One of the most commonly used options is electronic submission through clearinghouses. This process involves the use of third-party intermediaries to submit the claims from the providers to the insurance company.

Clearinghouses are used as centralized platforms designed to process and format claims based on the latest industry standards. Thus, they ensure your claims comply with all regulatory requirements, such as HIPAA standards, before forwarding them to the designated insurance company or payer.

Another benefit of clearinghouses is that they provide tools to track the claim processing status. This way, you can easily monitor the process and identify any potential issues that may delay your reimbursement.

Even though clearinghouses ensure a straightforward claim submission process, they also come with service fees. Some common costs are based on the subscription and transaction fees based on the number of claims submitted.

Direct submission

Direct submission is the practice of submitting claims directly to the designated insurance company without intermediaries like clearinghouses. This means that you and your providers must prepare and submit the claims yourself, either through a paper submission or electronically.

Healthcare institutions frequently choose to submit electronically through the systems of insurance companies because of the uniform forms, such as EDI transactions that comply with HIPAA. But there are other workable paper forms, such as CMS-1500 and UB-04.

However, since paper submissions require manual preparation, they’re often subjected to errors. That’s why we recommend using the electronic option as a more efficient method that speeds up the claim processing cycle.

Moreover, direct submissions help you establish personal communication with the insurance company. Such interactions can help you resolve potential claim-related issues. Although you’ll have to be mindful of the regulatory requirements of patient data confidentiality, you’ll save on administrative costs associated with using clearinghouses.

Adjudication and payment

Claim adjudication focuses on reviewing the accuracy of the claim. The insurance company uses the claim adjudication process to evaluate any healthcare claims to determine eligibility for reimbursement.

Since the claims have to be processed fairly based on the patient’s unique insurance policy, this component must assess the insurance coverage details, the medical necessity of the healthcare services, and regulatory guidelines. Before the insurance company accepts or denies the claim, it has to be reviewed and assessed by focusing on the following elements:

- Eligibility verification: The first element insurance companies need to do is to verify the patient’s insurance coverage. This allows them to determine if their insurance policy covers the services offered to them.

- Coding review: Claims must also be checked for their coding accuracy to identify any errors that must be addressed. This includes procedure and diagnosis codes, as well as modifiers, to ensure there aren’t any discrepancies.

- Determination of payment or denial: Based on the information they’ve gathered, insurance companies have to decide whether to approve, deny, or partially deny the claim. Thus, they’ll either fully cover the claim, reduce the amount paid, or explain its denial.

Factors Influencing Payment Determination

Several factors influence the payment determination process. The ones that have the biggest impact on this decision are the following:

- Coverage policies: Remember that each insurance company has its unique policies. Thus, the patient’s coverage may vary depending on their benefit plan. To ensure that a fair amount is reimbursed, you have to be mindful of the patient’s coverage limitations, deductibles, copayments, and coinsurance.

- Fee schedules: Some insurance companies may have predetermined fee schedules for reimbursement rates based on specific medical services. However, the payment amount may vary depending on the provider’s location and specialty.

- Contractual agreements: Healthcare providers might sign contracts with insurance companies that determine their payment terms, billing procedures, and reimbursement rates. If you’re part of such a participation agreement, you will most likely be paid based on the terms outlined in the contract.

Denial management

We want to highlight the importance of proper denial management. As claims can either be approved or denied, you should always be prepared to address the potential denials.

Hence, this systematic process deals with identifying, analyzing, and resolving claim denials from the insurance companies. Since a denied claim means that the insurance sector refuses to reimburse your healthcare provider for the services they’ve offered, it can lead to revenue loss.

By promptly addressing these denials, you’ll be able to ensure timely payment and improve your cash flow, which is critical for maintaining a healthy revenue cycle. To better understand this process, here are the steps you should know:

- Identification

- Analysis

- Appeals

- Tracking results and follow-ups

Identification

You’ll need to identify the claims that have been denied. While it may sound easy, tracking these claims requires reviewing reports from payer portals and practice management systems.

This gives you insights into the most common types of denials and the services affected. By gathering information about the providers, payers, and procedures related to the denials, you’ll be able to uncover where the errors are occurring and if the payers are making a mistake.

Analysis

The next step is to analyze and address the reason behind the denial. That being said, the most common denial reasons are the following:

- Coding errors: One of the main reasons for claim denials is coding errors involving diagnosis and procedure codes. To prevent potential denials, you should always be mindful of outdated codes and codes not covered by the patient’s insurance. Furthermore, you should ensure that the codes match the documentation related to the case.

- Improper documentation: Many claim denials arise from incomplete or incorrect patient information. Thus, you should always double-check if you have all the needed demographic details, insurance information, and policy numbers.

- Lack of medical necessity: Many insurance companies may deny your claim if they believe that the services you’ve offered aren’t a medical necessity. So, you should always have the needed documentation to support your claims and prove the service needs.

- Eligibility issues: The insurance company may deny your claims if the services rendered to the patient aren’t covered by their insurance plan. To prevent any issues, it’s important to verify the coverage information and inform the patient about the out-of-pocket expenses before you provide any non-covered services.

Appeals

Once you’ve determined the claim and the reason for its denial, the next step is filing for an appeal to contest them if they’re unjustified. The insurer will cover the claim in question if your appeal is backed up by the necessary documentation and evidence to support its validity. Also, you should always address the reasons for the denial and note them to prevent further errors.

Tracking results and follow-ups

You should always track your results and be prepared for follow-ups. Once you’ve sent your appeal, it’s important to monitor its status for a timely resolution.

In some cases, the insurance company in question may request a follow-up where you’ll need to provide them with any additional information they need. By communicating with the payer representatives, you can advocate for reconsidering the claim denials.

Claim Processing Workflow

So, how does claim processing work? As with any business operation, this process has several distinguishable steps you should consider.

Since it’s one of the more complex healthcare operations, we’ll elaborate on each step separately. That being said, here’s how claim processing works:

- Patient Registration

- Provider services

- Regulating charges and claim creation

- Claim adjudication

- Claim approvals or rejections

- Payment processing

- EOB (Explanation of Benefits)

Patient Registration

The first step in claim processing is patient registration. Once the patient has scheduled an appointment or visited your facility as a walk-in, they first have to check in at the registration desk.

That allows you to gather the necessary information regarding the patient’s demographic and insurance data. This will then be used to provide the appropriate care and bill accordingly.

Source: freepik.com / Photo Contributor: user850788

Provider services

Next, the patient meets with the designated physician or healthcare provider to get diagnosed and treated. These provider services can also include necessary testing and results, which are all documented in the patient chart and EHR (Electronic Health Records) system.

Regulating charges and claim creation

After the healthcare provider has provided the patient with the needed services, they have to regulate the charges and create the claim. Before submitting the claim to the insurance company, it’s important to provide detailed information about the services provided, as well as data regarding the patient and provider. This includes any diagnosis, procedures, and medication alongside their appropriate medical codes.

Claim adjudication

After you’ve submitted your claim, it has to go through the adjudication process to verify its eligibility. Since patients have different types of insurance policies, their coverage, copays, and deductibles have to be reviewed.

Furthermore, the insurance company has to decide if the services rendered to the patient were a medical necessity. This way, they can properly reimburse the medical provider.

Claim approvals or rejections

Once your claim has been reviewed, the insurance company has to decide if they’ll approve or reject it. If all the documentation is in order and the claim is justifiable, the next step is payment processing. However, if the claim has been denied, your team should focus on denial management and review the decision before filing an appeal.

Payment processing

If your claim has been successfully approved, the next step is for the insurance company to decide how much they will pay the provider for their services. The two types of payment you can expect are either full or partial, depending on the insurance plan.

However, many healthcare organizations have predetermined contracts about reimbursement rates. In such cases, you’ll be paid according to the terms of the agreement.

EOB (Explanation of Benefits)

After the insurance company has reached a decision, they have to send out an EOB statement to the patient and provider about their conclusion. This document should detail the services that were covered and how much is paid by the insurance. This way, both you and the patient will have a clear overview of the remaining balance owed by the patient.

Types of Claims

Even after you’ve memorized the entire claim process, there are different types of claims you should know. The most common ones you should know are the following:

- Medical claims: Claims by medical providers and physicians regarding services offered in hospitals, urgent care centers, and emergency rooms.

- Dental claims: Claims by orthodontists or oral surgeons regarding dental services, including orthodontic procedures, oral surgeries, and preventive care.

- Pharmacy claims: Claims by prescription drug providers or pharmacies regarding the medication given to the patient. It’s important that they include the name, dosage, and quantity of the prescribed medicine.

- Institutional claims: Claims by clinics, hospitals, or ambulatory surgery centers regarding the services offered to patients during inpatient or outpatient hospital visits or stays. This can include any diagnostic tests, medication, surgeries, and boarding provided to the patient.

Healthcare Coding Systems

One of the most complex parts of claim processing is understanding the various healthcare coding systems you should use. Since they’re used for documenting medical procedures, services, and diagnoses, you must be mindful of which option you use for proper claim processing. To have a better understanding of which codes to use, here are the most common options you should know of:

- CPT

- HCPCS

- ICD-10-CM/PCS

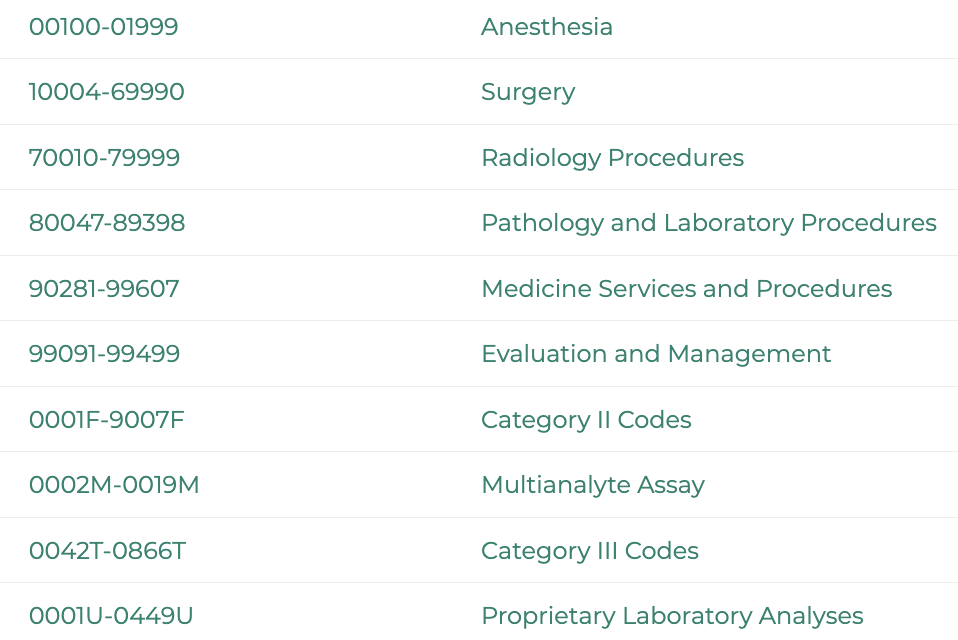

CPT

The Current Procedural Terminology is used for medical services or procedures rendered by healthcare providers within outpatient or office settings. These five-digit codes can be both numerical and alphabetical, depending on their category.

Furthermore, they include various medical services. For example, office visits, diagnostic tests, therapeutic procedures, and surgeries.

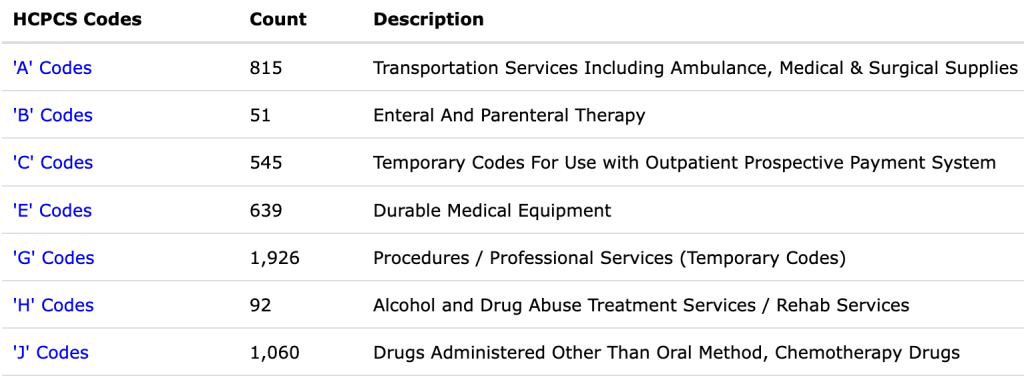

HCPCS

The Healthcare Common Procedure Coding System was introduced by the Centers for Medicare and Medicaid Services. This collection of standardized codes is used for medical services, procedures, and supplies covered by insurers like Medicare.

Divided into two subsystems, the HCPCS Level 1 is similar to the CPT codes, while HCPCS Level 2 is meant for supplies and services not mentioned in the CPT system. Distinguished by a letter following the four-digit code, this system includes dental terminology, ambulance services, and prosthetics.

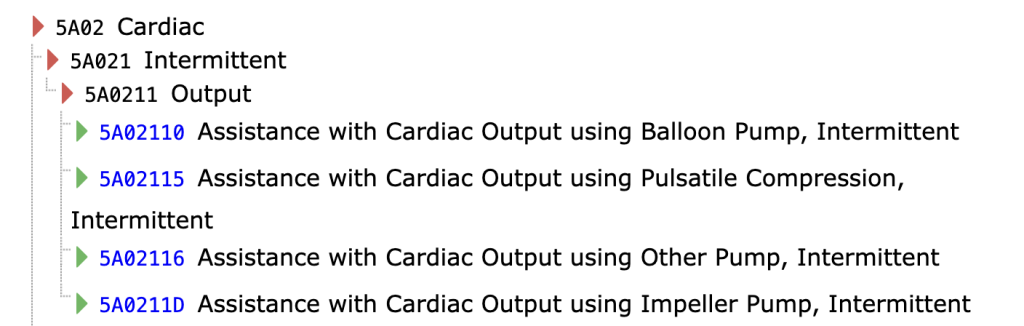

ICD-10-CM/PCS

ICD-10 is the latest revision of the International Classification of Diseases. From there, two subcategories were developed, known as the ICD-10-CM (Clinical Modification) and ICD-10-PCS (Procedure Coding System). While the first is used as a standardized system for classifying health conditions, diseases, and injuries, the latter is designed for reporting inpatient procedures within a hospital setting.

Conclusion

So, what is claim processing in healthcare? After elaborating on the process and importance of claim processing, it’s safe to say that it’s one of the most crucial factors in running a healthcare organization. Since it determines if or how much your organization will get reimbursed, it’s important to stay mindful of its elements and factors.

Knowing that many new medical businesses struggle with the complexity of this process, our team at CLICKVISION BPO has designed a new sector that focuses on meeting the diverse needs of the healthcare and insurance industries. This includes various healthcare process optimization services, from medical billing and coding to end-to-end outsourcing.

With our commitment to deliver solutions perfectly tailored to your requirements, we’re capable of meeting your unique needs regardless of your circumstances. So, contact our team today and discover how you can streamline your processes!

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.