Healthcare organizations must ensure proper medical billing and claim submissions to get reimbursed for the services provided. Once the claims have been submitted, the insurance company has to review them and decide whether to approve or deny them. That’s why, in this article, we’ll elaborate on the claim adjudication process in healthcare and its impact on your revenue cycle.

By highlighting and explaining the key components of claim adjudication, you’ll get a better overview of the process itself. Furthermore, we’ll discuss some of the most common claim denial reasons so you can better prepare to combat them. Continue reading to discover all there is to know about claim adjudication and its importance in your healthcare organization!

What Is Claim Adjudication Process in Healthcare

Claim adjudication is the process where insurance companies assess healthcare providers’ claims for validity and reimbursement eligibility. Since it requires a thorough review, it’s first used to ensure the claim is accurate and compliant with the insurance policy before they decide how much will the provider be reimbursed for the services provided.

During claim adjudication, insurance companies have to ensure that the claim has all the needed documentation, proof of medical necessity(if needed), and appropriate medical codes. Once they’ve analyzed the information, they can either pay the claim in full, partially deny it by reducing the amount paid out, or deny the claim by refusing to pay any of the services provided.

The reason why this process is considered an essential part of healthcare business operations is because it helps manage healthcare costs and compliance with policy terms.

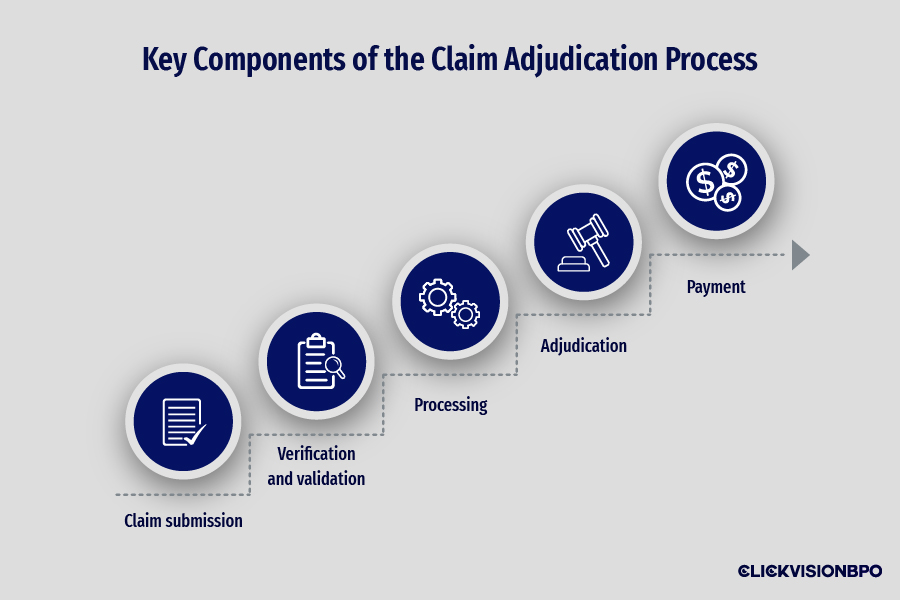

Key Components of the Claim Adjudication Process

To better understand their meaning and importance, we’ll elaborate on each of component separately. That being said, here are the main steps in claim adjudication:

- Claim submission

- Verification and validation

- Processing

- Adjudication

- Payment

Claim submission

Healthcare providers must document and file claims for their services to get reimbursed and ensure a healthy revenue cycle. The process acts as a formal notice to the insurance company that the healthcare organization has completed a specific set of services and is ready to get them reviewed to determine the payment.

The best way for healthcare providers to ensure they get reimbursed is by documenting the services provided and appointing the proper medical codes for them. Furthermore, you must complete a standardized claim form such as the CMS-1500 or UB-04. Both these documents require you to fill out specific information, such as:

- Patient and provider information (name, address, date of birth, insurance ID, NPI numbers)

- Description of the services provided (date and type of services, proper diagnosis and procedural codes)

- Charge for each service

Once the forms are completed, they should be forwarded to the appropriate payer. This can be done automatically through Electronic Data Interchange (EDI) systems or manually as paper claims.

Source: freepik.com / Photo Contributor: user7814140

Verification and validation

The initial review focuses on verifying the basic information and completeness of the claim form itself. Additionally, the payers must ensure that the patient had an active insurance policy when the services were provided.

In the second step of the process, the insurance company has to review all the submitted documents and verify the medical necessity, insurance benefits, pricing, and coding. While common errors such as duplicate claims and coding issues can be automatically checked through the use of software, ensuring compliance with the policy terms and assessing the medical necessity often requires manual review.

Lastly, the insurance company has to compare how much the healthcare provider has billed for the services with their fee schedule. Since the fee schedule acts as a predetermined list of charges for the services that healthcare providers offer, it will be used to determine how much the provider will be reimbursed based on the payer’s allowed amount.

Claim processing

Another key component of claim adjudication is the claim processing. In this phase, insurance companies focus on gathering all the needed information used to determine the amount they’ll pay for the claims. This includes the submitted claim form, the patient and provider information, and the essential medical records and codes. To ensure that the healthcare provider gets reimbursed properly, they must review all the claim details before making a final decision.

Adjudication

Once the insurance company has thoroughly reviewed the claim, they have to decide whether to approve or deny the claim during the adjudication process. Depending on the documentation the healthcare organization has provided, the three outcomes you can expect are full claim approval, partial denial, and, worst case scenario– full denial. If the insurance company hasn’t found any issues within the claim form, documentation, and coding, they will approve the claim and reimburse the full amount for all the services billed, according to the fee schedule. In case the insurance company decides that some of the services provided aren’t of medical necessity or miss the appropriate codes, they can partially deny the claim and only reimburse the provider for the services they deem necessary.

If the claim is deemed unfit for reimbursement, the insurance company will fully deny the claim and refuse to pay for any of the services offered.

Payment and remittance

The last key components of claim adjudication are payment and remittance. Once the insurance company has decided whether to approve or deny the claim, they have to inform both the patient and healthcare provider of their decision.

If the claim has been fully or partially denied, they send ERA (electronic remittance advice) documents explaining the reason behind the denial. You may also receive an EOB (Explanation of Benefits) document where the payer provides details about the expected payment amount and explanations for reduced or denied reimbursement while also highlighting any adjustments made.

On the other hand, if the insurance company has approved some or all of the services mentioned in the claim, they have to issue payment to healthcare providers based on the adjudication outcomes. Remember that the reimbursement rates may vary depending on the insurance company’s determined coverage and payment rules.

As for the payment itself, it’s usually sent directly to the healthcare organization’s designated bank account or conducted through an EFT (electronic funds transfer). Once the payment has been received, healthcare providers are required to record it in their patient systems for accurate payment tracking.

Reasons for Claim Denials

Even though you may have already familiarized yourself with the claim adjudication process, you may still run into claim denials. The best way to prevent such issues from occurring in the future is to inform yourself about the most common denial reasons. That being said, here are the most common reasons healthcare organizations may receive a claim denial:

- Coding errors – one of the most important aspects of medical billing is using appropriate medical codes. Failing to appoint the correct ICD-10 or CPT codes to describe your patient’s diagnosis and treatment will surely result in a claim denial.

- Lack of medical necessity – if the insurance company has determined that the services you’ve provided aren’t a medical necessity, they will refuse reimbursement.

- Incomplete documentation – while often overlooked, having missing information from your documentation is one of the most common reasons for claim denials.

- Eligibility issues – the last common reason for a claim denial is due to an inactive or expired patient insurance policy. Remember, healthcare organizations must verify the patient’s insurance status before offering services.

Appeals Process

Even though your claim has been denied, you can still appeal the insurance company’s decision within their specified timeline. To ensure the best outcome, you should always implement effective denial management strategies beforehand. This helps with faster claim denial identification and review, which allows you more time to correct the errors that have caused it.

Before you submit your appeal, you must include all the missing information and correct any potential coding mistakes. Once you’ve ensured the claim’s accuracy and completeness, you can then resubmit it for reevaluation. Moreover, you should be aware that different payers have different deadlines within which you can submit your appeal. So, it would be best if you always familiarize yourself with their rules and guidelines to prevent missing your window of opportunity.

Conclusion

After explaining the claim adjudication process in healthcare, we hope you get a better understanding of why claim denials may occur. Since medical billing is one of the most complex operations when running a healthcare organization, we advise you to familiarize yourself with the details of claim submissions, processing, and adjudication to prevent future errors.

Since many medical facilities prioritize patient well-being, they often overlook the importance of optimizing this side of their business operations. That’s why our team at CLICKVISION BPO has a sector that specializes in medical billing outsourcing services for the healthcare industry. Our customizable services and tailored solutions can streamline your business processes to ensure fast and efficient results. So, contact us today and discover the best optimization opportunities for your specific circumstances!

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.